Oil and Gas is a Cyclical Business

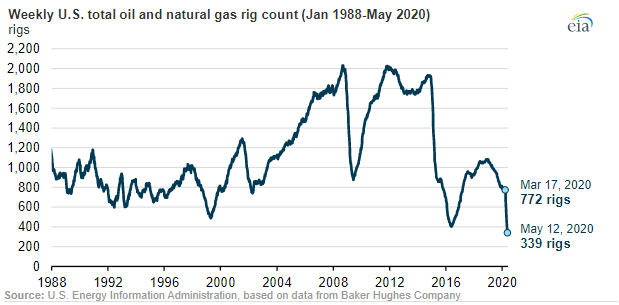

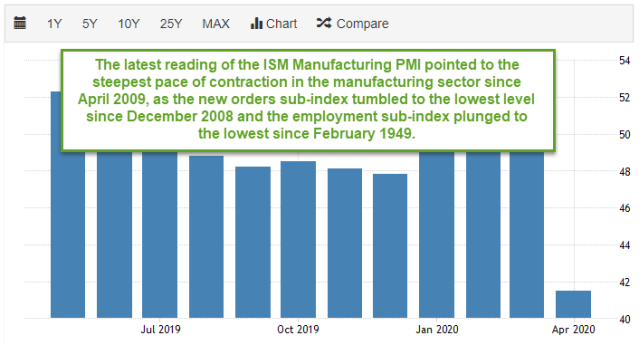

It’s no secret that oil demand has been demolished by the novel coronavirus and coincident recession, but in my experience the best indicator of supply adjusting to the downside is activity in the oil patch. In May, the Energy Information Administration reported the fewest oil and natural gas drilling rigs on record working in the United States.

The time to buy into oil and gas companies is when production cuts are underway and the major suppliers are working in tandem to stabilize the supply/demand balance.

Largest Oil and Gas Companies in Canada

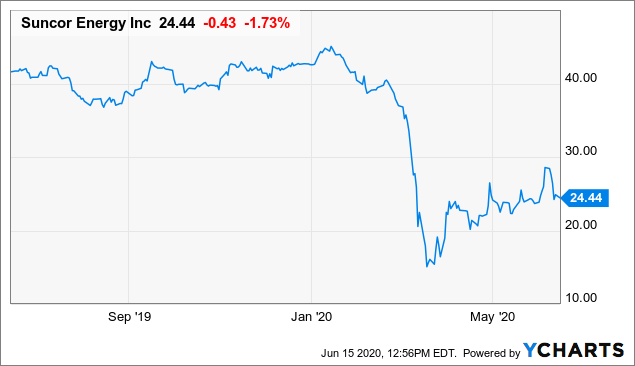

In August of 2009 Suncor (SU) merged with PetroCanada to become the largest integrated producer in Canada. The company reported cash flow for the first quarter of 2020 of $0.91 compared to $0.98 in the 1st quarter of 2019. The company pays a dividend of $0.31 per share. It’s 52 week price range on the Toronto Stock Exchange is $45.12 – $14.02 and its currently trading just above $24. I bought this a few weeks ago.

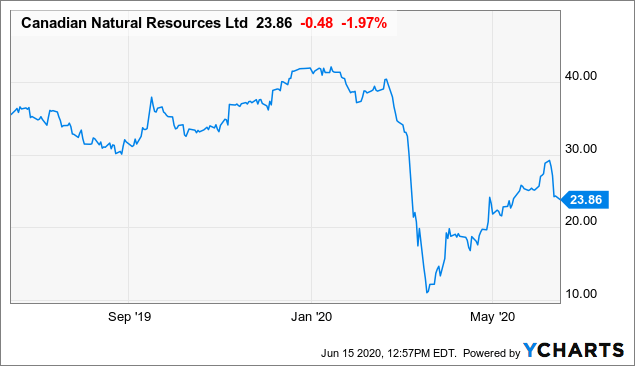

The second largest (and my current ‘planning-to-buy’ stock) energy company and the largest ‘independent’ in Canada is Canadian Natural Resources (CNQ). The dividend was actually increased to $0.425 per share – a refreshing departure from so many other industry players who’ve cut their dividends. Fund flows from operations also covered their capital expenditures. The 52-week range for the stock price is $42.57 – $9.80 and trades near $24 on the TSX.

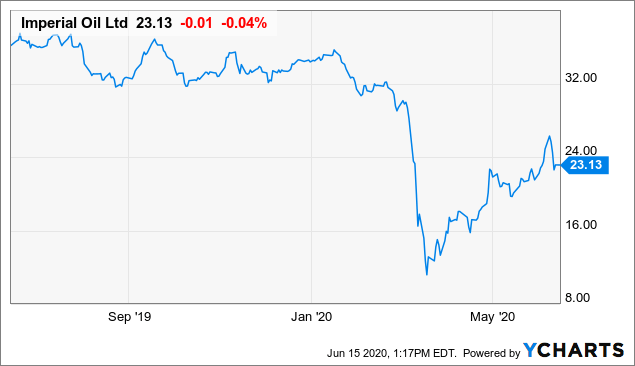

The third company I’d like to discuss is Imperial Oil (IMO on the Toronto Stock Exchange). Founded in 1880 in Canada, it owns 25% of Syncrude – one of the largest oil sands producers in the world. The integrated oil and gas company is majority (69.6%) owned by ExxonMobil. Cash flows from operations declined significantly (down 58%) year-over-year, no doubt due to the large portion of their business tied to the costly oil sands. The stock is trading around $23, pays a dividend of 22 cents per share and it’s 52 week range is $37.75 – $10.27.

Experience Matters

I’ve been involved in the investment management business in Canada for nearly 40 years and have witnessed the same pattern of Americans investing in the Canadian energy sector over and over again. Once oil prices have already risen, and the Canadian dollar has strengthened against the USD there is a stampede of US institutional investors buying Canadian oil and gas companies. When US interest in Canadian companies peaked, I would sell the sector outright. Whenever confronted by a complete lack of foreign investor interest, I would buy. We are once again in the ‘buy’ zone.

Anecdotally, there are other contrarian indicators that inspire confidence that the time is ripe. Consider this headline from the Canadian national newspaper (the Globe & Mail, June 12, 2020):

Don’t be too quick to buy TSX energy stocks.

When the press is sufficiently negative, the sellers have sold and tide is about to turn. Another contrarian indicator that is unique to Canada is the wholesale firing of energy investment analysts. Here’s another headline (also from the Globe & Mail, June 11th, 2020) announcing a move by one of Canada’s leading independent investment dealers.

Canaccord Genuity cuts staff, suspends coverage of 18 energy firms

A lesson I learned over many years as a portfolio manager a resource-based economy is that when things can’t get any worse, they soon get better.

I fully understand why investors are enamored by tech, gold and of course the pharma companies. What else is there? However there will come a point at which a recovery in the more downtrodden sectors is on the horizon (it will be awhile though, with plenty of disappointing earnings and economic announcements beforehand) and like Warren Buffet, I’d like to have some cash available for that eventuality. (PS I’ve also trimmed my gold weighting).

I fully understand why investors are enamored by tech, gold and of course the pharma companies. What else is there? However there will come a point at which a recovery in the more downtrodden sectors is on the horizon (it will be awhile though, with plenty of disappointing earnings and economic announcements beforehand) and like Warren Buffet, I’d like to have some cash available for that eventuality. (PS I’ve also trimmed my gold weighting).

Everyone is confused – He bought a bunch of airlines at their peak, and sold them all (was the normally undaunted investor suddenly in a panic?) at the bottom. “Fear is the most contagious disease you can imagine…” said Buffett at his annual shareholder meeting. He also said:

Everyone is confused – He bought a bunch of airlines at their peak, and sold them all (was the normally undaunted investor suddenly in a panic?) at the bottom. “Fear is the most contagious disease you can imagine…” said Buffett at his annual shareholder meeting. He also said: After all, the same guy bailed out the major US banks during the last financial crisis, and later saved Canada’s mortgage lender Home Capital when they were in dire straits. Brave moves like these made him and his shareholders lots of money.

After all, the same guy bailed out the major US banks during the last financial crisis, and later saved Canada’s mortgage lender Home Capital when they were in dire straits. Brave moves like these made him and his shareholders lots of money.

From the Financial Times:

From the Financial Times: Over many years I’ve marveled at how reliable consumer sentiment has been as a contrarian indicator. When it reaches rock bottom then the markets, followed by the economy begin to recover from a crisis – whether a recession or financial. The University of Michigan Index of Consumer Sentiment just came out and is holding relatively steady (just above the 70 level) so far this month.

Over many years I’ve marveled at how reliable consumer sentiment has been as a contrarian indicator. When it reaches rock bottom then the markets, followed by the economy begin to recover from a crisis – whether a recession or financial. The University of Michigan Index of Consumer Sentiment just came out and is holding relatively steady (just above the 70 level) so far this month.