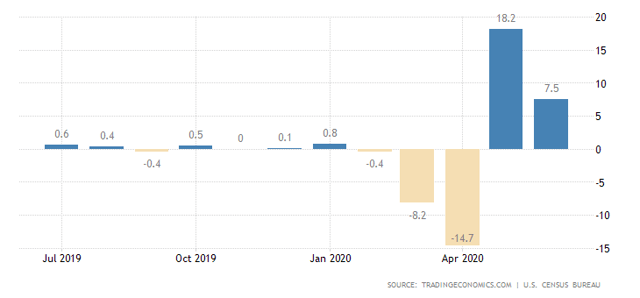

Retail sales continue to rebound despite the slow opening of the economy. Inevitably, many storefronts will not survive but those that do will be able to negotiate much more favorable terms when it comes to rent. The online capabilities of retailers with strong and growing brands have also been improved as they’ve had to adjust over the past several months.

Retail Sales – United States

The retail sales report showed 10 of 13 major categories increased, reflecting solid gains in furniture, electronics and appliances, clothing and sporting goods. Purchases at apparel shops jumped 105.1%, while electronics and appliances outlets saw a 37.4% gain. (Bloomberg.com)

Even in Canada, retail sales jumped 18.7% in May according to Statistics Canada. The two stocks – one a larger cap and the other a smaller cap – I believe should be owned are retail Canadian retail growth situations.

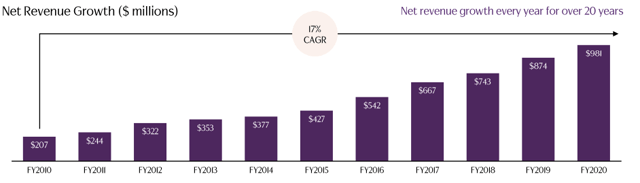

Aritzia Inc. (“ATZ” on TSX) – Smaller Cap Growth

COVID-19 restrictions caused the closing of all Aritzia stores (it’s been the bane of all retail) but since May 7th, 30 of its boutiques opened up again during its first quarter of 2021 and many more have opened since (89 of 96). Sales have been running about 55% to 65% of last year’s levels at the stores. Despite the difficult environment experienced, the company plans to open five to six new boutiques this year. Online sales surged 150% during the quarter – testimony to the power of their brand.

The key to continuing success is the strong financial position (Long-Term Debt to Equity is 24%) of the company. At the end of the quarter, it had $224 million in cash available with capital expenditure plans of only $35 million. With a bit over 109 million shares o/s and based on its recent share price, the market cap is $1.94 billion.

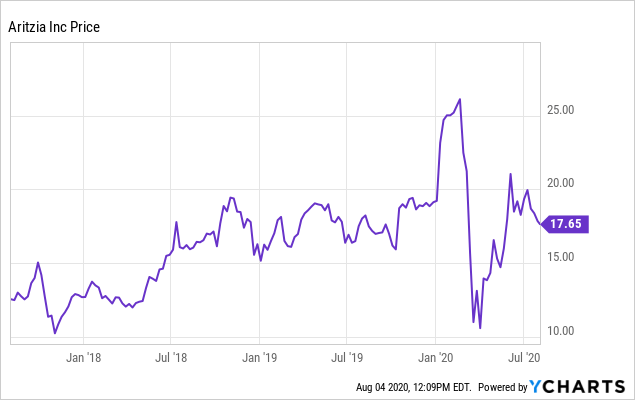

Data by YCharts

Data by YChartsThe stock has since recovered from the lows but remains about 35% below its pre-coronavirus levels. A precise valuation is difficult given the uncertainty going forward, however, the P/E based on 2020’s year end (a proxy for ‘normal’) EPS of 84 cents suggests a 21X multiple – which is reasonable for a business with its track record of consistent sales growth.

Source: aritzia.com

The company plans to continue penetrating the enormous US market and, recently, announced plans to open two new locations in New York and Los Angeles. An example of the attractive lease opportunities is the New York location:

The long-term lease in New York is on a prominent corner in Manhattan’s SoHo district, in a space that formerly housed luxury food shop Dean & DeLuca, and is costing Aritzia “25 to 30 cents on the dollar” compared with what it would have been two to three years ago. (Source, Globe & Mail, July 10th, 2020)

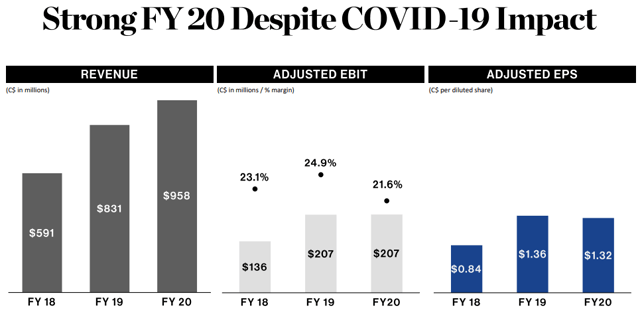

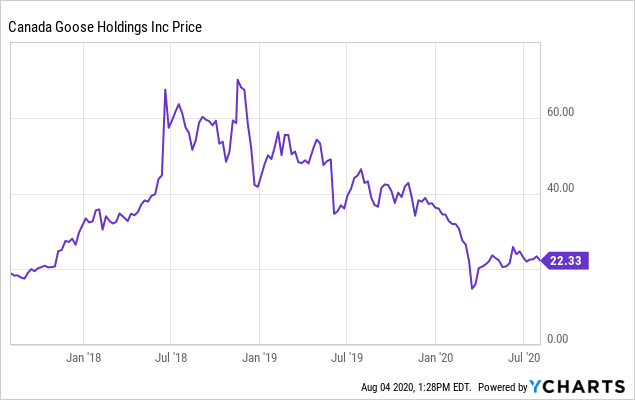

Canada Goose Holdings Inc. (GOOS) – Larger Cap

Canada Goose announced it will report its first quarter of 2020 results prior to the market open on Tuesday, August 11, 2020. We know the numbers won’t be pretty and may present a unique buying opportunity for this growing Canadian retailer.

Founded in a small warehouse in Toronto almost sixty years ago, Canada Goose has grown into one of the world’s leading makers of luxury apparel.

Fiscal 2020 Highlights (in millions of Canadian dollars):

- Total revenue increased by 15.4% to $958.1m

- Net income was $151.7m or $1.36 per diluted share

- Adjusted EBIT was $207.4m, representing a 21.6% margin

- Adjusted net income was $147.2m or $1.32 per diluted share

Acknowledging that their pending first quarter or the balance of this coming year will be anything but normal (will be ugly), the P/E using the 2020 EPS as a proxy of sorts suggests the stock is trading at roughly 17X. Market cap at current prices is about $3.3 billion.

Data by YCharts

Data by YChartsThe most exciting opportunity for GOOS is its foray into the Asian market. China, Japan plus South Korea account for just 21% of revenues but sales growth in that part of the world was 78% last year. China’s economy is widely known to have been rebounding nicely since it was hit by COVID-19 and should contribute to the company’s recovery over the next several quarters.

Target Prices – Through the Valley

I believe a conservative expectation for Aritzia is a resumption of its historical growth rate and per share earnings in the neighborhood of $1.15 2 years hence. At 25X earnings, my target over two years (I anticipate it will trade based on this EPS estimate this time next year) is $28. A 55% potential return.

My target for Canada Goose, arrived in a similar fashion, is $2.00 EPS and, with a 20X multiple, yields a $40 price for almost a 33% gain within 12 months.

Timing – Always Buy Retail in Summer Months

Seasonality should not be a surprise when it comes to investing in the retail sector. Canada Goose is famous for its winter luxury apparel (they’ve now expanded into footwear) which is hardly at the top of investors’ minds during the summer. In general, the shopping months (4th quarter) are when we will see revenue strength, and despite the pandemic, this year will be no exception.

The odds of better-than-expected retail profitability are quite good due to the operating leverage that surviving (and thriving) retailers have due to severe cost-cutting during the last several months (and ongoing). Salary reductions in the executive ranks, lower SG&A expenses, abatements on rent expenses, careful inventory management, and so forth will serve to improve margins materially.