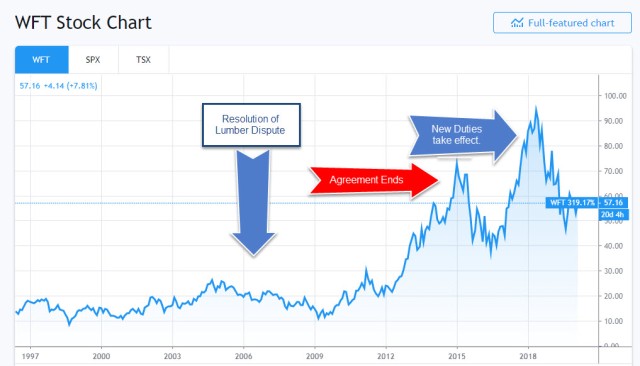

I recall the good news for Canadian lumber stocks back in 2006. The US and Canada had finally resolved the lumber dispute. The United States would lift countervailing and anti-dumping duties subject to certain conditions. Even better, the lumber companies would get refunds of those payments.

Refunds totaling $950 million have been given to Canadian companies that had paid duties to the U.S. over the past four years.That represents about 20 per cent of the estimated $5 billion that will be returned. (rom CBC News ·

I bought a few of the stocks in client funds and did very well.

The stage is set for another potential windfall in the sector (and I admit, I did buy one stock personally so far). This news came recently (quote from Globe & Mail, FEBRUARY 3, 2020):

The stage is set for another potential windfall in the sector (and I admit, I did buy one stock personally so far). This news came recently (quote from Globe & Mail, FEBRUARY 3, 2020):

The Commerce Department ruled late on Monday that tariffs imposed on most Canadian lumber sold south of the border could be reduced, after conducting an administrative review of anti-dumping and countervailing duties applicable for 2017 and 2018.

In its preliminary assessment of most Canadian producers, the Commerce Department pegged the combined anti-dumping and countervailing rate at 8.21 per cent, down from 20.23 per cent levied more than two years ago.

The reduction in duties comes at an opportune time. Lumber prices has been rising – and of course it’s when lumber prices are low that the US lumber lobby gets angry.

Lumber increased 33.50 USD/1000 board feet or 8.24% since the beginning of 2020, according to trading on a contract for difference (CFD) that tracks the benchmark market for this commodity (see chart below of lumber prices of late USD/1000 board feet).

source: tradingeconomics.com

I’m not suggesting the very near term environment will be bliss, as it was between 2006 (when the dispute was last settled) and 2015 when it got red hot yet again with no trade barriers. Yet this is a good start to be sure. Soon the companies will be reporting their 4th Quarter results, which might put some pressure on the stocks (or not) – but it’s the future that matters.

Going forward, should lumber prices remain firm, then the US lobby won’t care much about imported lumber from Canada, and the countervailing duties just might disappear for awhile. If I’m wrong, the stocks won’t go up much (no loss) but if I’m right then the sector stands to start making some respectable profits again. With low interest rates seemingly here to stay thanks to a slowing in global growth, the US housing market stands to benefit.

var tradingview_embed_options = {};

tradingview_embed_options.width = ‘640’;

tradingview_embed_options.height = ‘400’;

tradingview_embed_options.chart = ‘PILGAcSD’;

new TradingView.chart(tradingview_embed_options);

Canadian Lumber Stocks Poised to bounce. by malvinspooner on TradingView.com